Australian housing market update for December 2025

Australian housing market update for December 2025

National home values rose 1.0% in November (slowing from 1.1% in October), marking the third consecutive month of 1%+ growth.

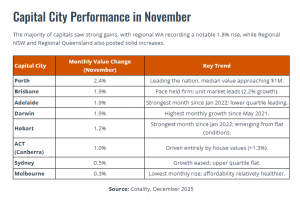

Mid-Sized Cities Lead the Surge: Perth (2.4%), Brisbane (1.9%), and Adelaide (1.9%) led the market, while Sydney (0.5%) and Melbourne (0.3%) saw a deceleration in growth.

Record high affordability barriers (8.2x value-to-income ratio) and persistent low supply (40% below average in Perth) mean demand is being concentrated in the most affordable segments and capitals.

Persistently low supply levels remain the core upside factor. Advertised stock is tracking at least 40% below the 5-year average in Perth and 29% below in Brisbane, maintaining upward pressure on values despite the affordability ceiling.

Strong growth continues across the unit sector in several cities, driven by lower price points and heightened investor activity. In Brisbane, units (2.2% rise) are outpacing houses (1.8% rise). Darwin, in particular, is attracting significant investment, with investors comprising 49% of mortgage demand in the September quarter, driven by strong capital gains and high rental yields.

Nationally, credit growth for housing investment is rocketing, rising at its fastest pace since December 2014, with investors comprising around 41% of home lending.

Interest Rates: The growing expectation that interest rates will be held for an extended period, following the Q3 inflation shock, removes the prospect of a material boost to borrowing capacity.

Serviceability: Rising serviceability barriers are likely to limit the magnitude of future home value growth as credit becomes less available.

Regulatory Risk: Although the recently announced 20% limit on high Debt-to-Income (DTI) ratio lending is unlikely to slow price growth significantly, it signals that the regulator (APRA) is alert. A more overt policy adjustment, such as a renewed investment credit growth speed limit, remains a key downside risk given the high share of investor lending.

Overall, home values are expected to continue rising into 2026, but the pace of gains is likely to slow as affordability and serviceability constraints impose a natural ceiling on housing prices.

Source: Tim Lawless - Research Director at Cotality